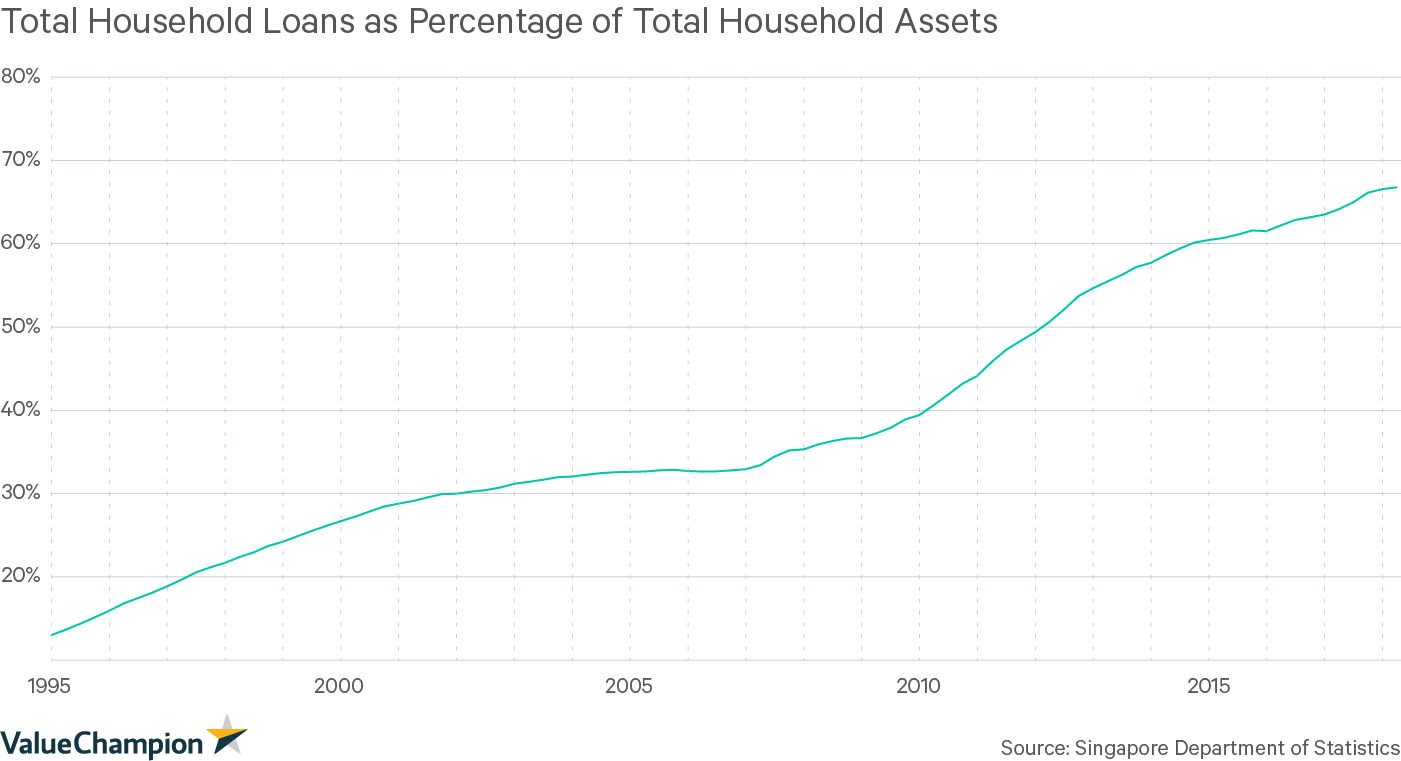

Outstanding loan balances for Singaporean households have increased steadily over the past 20 years, most recently reaching almost 70% of household assets. This means that Singapore’s residents are more saddled with home, education, car and other loan debt than ever before. How can individuals effectively manage their current debt and be savvy about taking on new debt? We looked to research by behavioural economists to provide strategies for borrowers seeking to get their personal debt under control.

Peer Pressure

Pressure from your friends and colleagues can be very influential. For example, it can be easy to be convinced into having another round of drinks with your friends or to work overtime if your coworkers are staying late. A study in the United States found that participants in a debt reduction program that included peer support and reminders were more likely to reduce their debt in one year compared to participants that did not take part in the debt reduction program. This suggests that you should engage your friends as part of your plan to repay debt. It could be as simple as having regular conversations about your progress or having a more formal arrangement with another friend that is also trying to manage their loans. Whatever you chose, make sure that this person is willing and able to check in with you about your progress, and to make sure you remain accountable to your goal of reducing your debt.

In Face of a Large Problem, First Take a Small Step to Financial Freedom

If you have several sources of personal debt, you may find it impossible to decide where to start sorting out your finances. While we recommend that borrowers always pay off loans that charge accumulate interest most quickly first, research from the University of Michigan suggests that some borrowers would pay off their total debt more quickly by focusing on smaller, more manageable debts before focusing on larger and more expensive loans. The theory of this payment technique, which is sometimes referred to as the “Snowball Method,” is based on the idea that borrowers will feel a sense of accomplishment from fully repaying smaller debts and might otherwise lose their momentum if they focused their efforts on repaying a larger loan. No matter what you choose, we suggest developing a manageable plan for repaying your loans that you will be able to stick to until you are debt free.

Make Debt Repayments Automatic

Nobel Prize-winning economist Richard Thaler’s research suggests that retirement plans are most effective when individuals are “nudged”, or incentivised, to automatically contribute to their retirement funds. This theory can also be applied to credit card or other personal debt. For instance, setting up auto-pay for your credit card bill, even for the minimum payment amount, can ease you into the process of repaying your debt. Clearly, the more you can automatically repay at a time, the better. However, it is still important that your checking account has enough money in order to make your automatic payments in order to avoid overdraft fees.

Other Ways to Manage Your Debt

One effective way that many Singaporeans are able to manage their mortgage, which is one of the largest loans an individual will ever have, is to refinance every few years. This method helps borrowers obtain cheaper rates for their existing loans and ultimately make their home ownership more affordable. You can use our home loan refinance calculator to find the best refinancing rates currently available in Singapore and compare them to your current loan’s cost and monthly repayments.

In addition to refinancing, it may actually be useful to consider consolidating your debt through a new loan. It may sound counterintuitive to take out yet another loan in order to pay off existing loans. However, some products are designed exactly for this purpose. For example, balance transfer loans and debt consolidation plans both offer borrowers the opportunity to consolidate their personal debt and repay at lower interest rates. If you have a significant amount of debt from credit cards or personal loans, you may find that you can save money by using either of these products. For example, balance transfer loans are especially helpful for borrowers that will be able to repay their debt within a few months to a year, as lenders tend to offer balance transfers with interest free periods of 3, 6 or 12 months. On the other hand, debt consolidation loans are better for long-term debt repayment as they charge lower effective interest rates than balance transfer loans do after their interest-free periods.

A Matter of Self-Discipline

Ultimately, in order to best control your debt, you will need to make difficult decisions about how to allocate your income to loan payments and other necessary spending categories. With that said, behavioural economic research gives you an insight into psychological phenomena that may help you be more successful in your journey to becoming financially healthy. Furthermore, if you must take on additional debt in order to attend university or purchase a car or home, remember to always compare rates and understand terms between lenders before adding to your total debt.

The article How Behavioural Economics Can Help You Pay Off Debt originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Source: VP