In a market environment which seems subdued after the last round of cooling measures, the en bloc sale committee of Phoenix Heights eventually settled on an amount substantially lower than its asking price of $36 million. The Board of Directors of OKP Holdings Limited together with its subsidiaries announced on 21 August that the tender submitted by the Group’s 25 per cent owned associated company USB Holdings Pte Ltd (formed for the acquisition of Phoenix Heights) at the tender price of $33.1 million was duly accepted by the Collective Sale Committee of the Phoenix Heights on 20 August 2018.

Phoenix Heights has a site area of 3,971.9 square metres and a leasehold tenure of 99 years with effect from 1969. The announcement said that USB intends to apply to the Singapore Land Authority for a grant of fresh 99 year lease for the property. USB plans to redevelop the property subject to obtaining all necessary approvals from the relevant authorities.

USB said that the tender price of $33.1 million, which was lower than the asking price of en bloc sale committee, was submitted after taking into account the prevailing market conditions and market prices of properties in the surrounding area.

USB indicated that it will be paying the purchase price as follows:

- a tender deposit of $180,000 which has been paid;

- an amount of $3,130,000 (being 10 % of the Purchase Price, less the tender deposit) is payable within 14 days from the Date of Acceptance; and

- the balance amount of $29,790,000 is payable on completion of the Acquisition: within 12 weeks from the Date of Acceptance; or within 12 weeks from the date of the sale order (if applicable), or, if an appeal is filed, within 12 weeks from the date the sale order is granted or affirmed by the Court of Appeal, whichever is the later; or within 12 weeks from the written confirmation of the solicitors appointed by the Collective Sale Committee of the Property that all registered proprietors of the units holding 100% share value have consented to the sale of their respective units in the Property, whichever is the later.

The Group said that it will fund its share of the Purchase Price by internal resources and/or bank borrowings.

Owners of the 32-unit Phoenix Heights in Bukit Panjang launched the collective sale for the 48-year old condominium on June 7 and the tender closed on July 10.

The asking price by the en bloc sale committee was $36 million, which translated to a land rate of about $668 psf per plot ratio (ppr), including the 10% bonus balcony space and premiums payable to top-up up the lease. Under the 2014 Master Plan, the site is zoned for residential use and has a plot ratio of 1.4.

The sale of Phoenix Heights comes after the Government announced a new round of cooling measures to calm property market euphoria. The Government said the new property cooling measures were necessary to check sharp increase in prices, which could run ahead of economic fundamentals and raise the risk of a destabilising correction later, especially with rising interest rates and the strong pipeline of housing supply.

JLL, a prominent real estate services company, in responding to the Government’s cooling measures said that there is a chance that the collective sales market will be dampened as developers become wary of end-demand and are hurt by the 5 per cent non-remittable ABSD on land purchase. This is expected to have an impact on their offer prices.

But considering that at least three freehold projects to sell en bloc were halted since the announcement of the property cooling measures, the accepted price of $33.1 million by the Phoenix Heights en bloc sale committee may be welcomed relief for the owners of the 99-year-leasehold property.

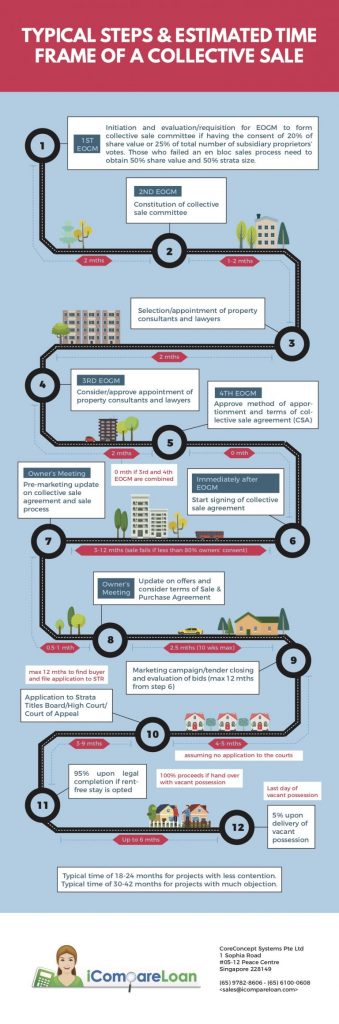

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

The subdued optimism of the collective sale market is not just a big blow to developers but also to en bloc beneficiaries shopping for a replacement property and investors. Ian Loh, Knight Frank executive director and head of capital markets noting this, said: “For owners, the cost of a replacement home has gone up, but the en bloc premium is likely to be reduced.”

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said whatever decision en bloc sale committee makes, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners.

One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

An en bloc sale committee must be mindful that as collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.