The Minister of National Development said in a parliamentary answer that 2,489 complaints were made against estate agents in the past 3 years – from 2016 to 2018.

The Minister, Mr Lawrence Wong, was responding to a parliamentary question asking:

“…over the past three years (a) how many complaints have been made to the Council of Estate Agencies (CEA) about property agents; (b) what is the nature of the complaints made; and (c) how many property agents have been sanctioned by CEA for misconduct?”

Responding to the question on estate agents, Mr Wong said:

“Between 2016 and 2018, the Council for Estate Agencies (CEA) received a total of 2,489 complaints against estate agents and salespersons, or an average of about 830 each year.

Most of the complaints related to service quality and unprofessionalism, such as no-show at appointments. CEA also received complaints on potentially misleading or inaccurate advertisements, and complaints on alleged misconduct, such as failure to declare conflict of interest.

There are three courses of action that CEA can take to punish errant estate agents and salespersons – Court prosecution, action by CEA’s Disciplinary Committee, or the issuance of warning letters.”

The Minister said that over the past three years, 23 salespersons were convicted in court for offences such as the illegal handling of transaction monies, and were fined.

He added that CEA’s Disciplinary Committee took action against 6 estate agents and 42 salespersons for misconduct such as failure to conduct their work with due diligence.

“The Disciplinary Committee meted out financial penalties, and suspended the salespersons’ registration status,” Mr Wong said; adding, “about 700 warning letters were issued to deal with minor infractions.”

The Minister’s answer on complaints received about estate agents comes as a survey showed that consumers continued to be satisfied with the property agent services rendered by their property agents.

The third Public Perception Survey on the real estate agency industry by Council for Estate Agencies’ (CEA) said the key findings from the survey suggested:

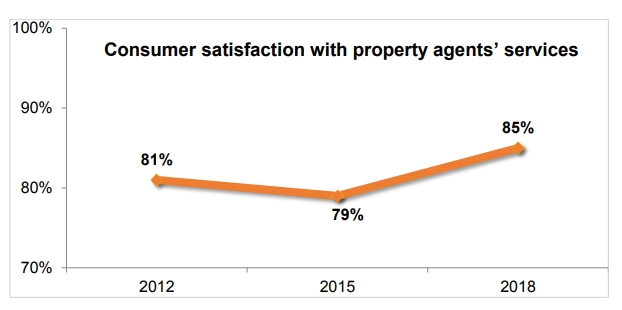

- 85 per cent of consumers in 2018 were satisfied with the service provided by their property agent. This is an increase from both the 2015 (79 per cent) and 2012 (81 per cent) surveys.

- Consumers whose agents used three or more forms of real estate technology tools during their property transaction were significantly more likely to have indicated that they were satisfied with their agents’ service. This was consistent for consumers across all age groups.

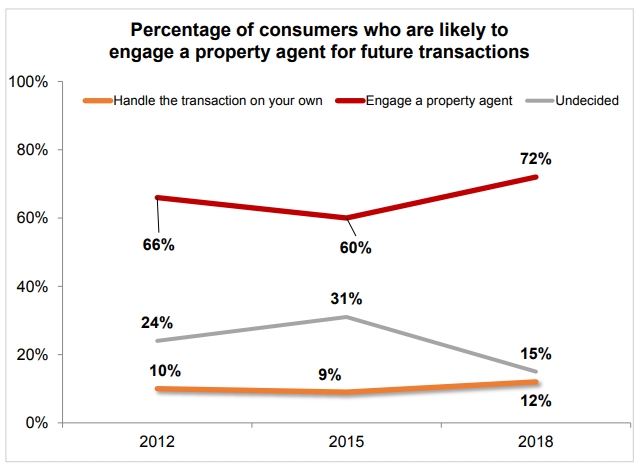

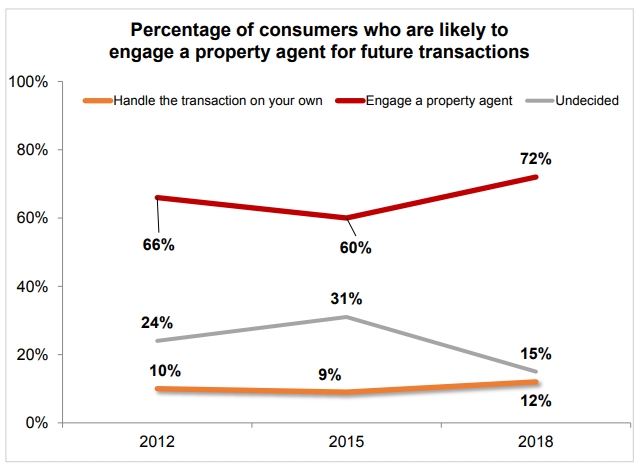

- 72 per cent of consumers indicated that they would engage the services of a property agent in future transactions. This is higher than that in 2015 (60 per cent) and 2012 (66 per cent).

The three-yearly survey involved some 1,500 respondents, comprising individuals who had engaged the services of a property agent and those who had yet to. Face-to-face interviews were carried out with respondents over three months from May to July 2018 at various locations around Singapore.

85 per cent of consumers surveyed in 2018 were satisfied with the services provided by their property agents. This represents an increase in satisfaction from both the 2015 (79 per cent) and 2012 (81 per cent) surveys. Satisfaction was consistently high among all consumer groups surveyed i.e. property buyers and sellers, landlords and tenants.

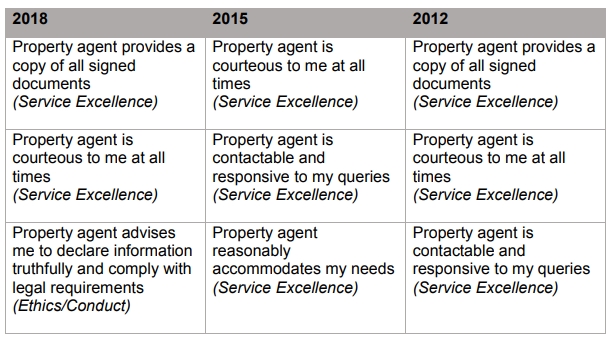

Consumers who you used property agent services were asked to rate their property agents on 18 action statements.

These statements are grouped into three professional attributes:

- Knowledge/Expertise

- Ethics/Conduct

- Service excellence

In 2018, consumers were most satisfied with their property agents in the area of Service Excellence, followed by Ethics/Conduct and Knowledge/Expertise. The top-rated attributes are:

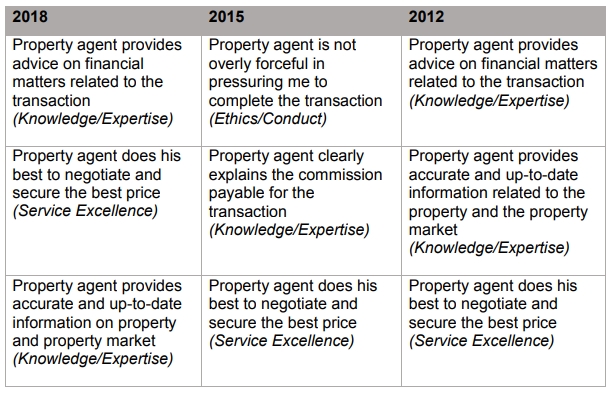

Attributes that drew lower satisfaction levels from consumers who used property agent services were in these areas:

In a result similar to the 2015 survey, property agents’ knowledge remained the most important dimension to consumers in 2018.

The 2018 survey was the first in which consumers were asked if their agents used any digital tools during the transaction. A third of respondents shared that their agents used at least one digital tool while facilitating the transaction. These tools included property apps with pricing calculators, information on property trends and property details, as well as electronic forms.

Consumers whose agents used three or more forms of real estate technology during their property transaction were significantly more likely to have indicated that they were satisfied with the services provided by their agents. This was consistent for consumers across all age groups.

As with the earlier two surveys, consumers who used estate agent services were asked if they intend to engage a property agent for future transactions. Consumers’ intentions with respect to future transactions were strongly related to their satisfaction with the service provided by their property agents. Related to the overall higher level of satisfaction among consumers surveyed, 72 per cent of them indicated that they would engage the services of a property agent in future transactions in 2018.

This is significantly higher than that in the 2015 (60 per cent) and 2012 (66 per cent) surveys. The proportion of consumers who were undecided decreased to 15 per cent from 31 per cent in 2015 and 24 per cent in 2012.12 per cent of consumers indicated that they would likely handle property transactions on their own, an increase from nine per cent in 2015 and 10 per cent in 2012.

The 2018 Public Perception Survey also polled consumers on their awareness of 12 key industry practices and regulations. The survey found that consumer awareness has increased compared to 2015 and 2012, with an average score of 77 percent, or nine out of 12 areas. The score in 2015 was 73 per cent, or close to nine out of 12 areas. In 2012, the average score was 72 per cent, or eight in 11 areas.

How to Secure a Home Loan Quickly

Are you planning to invest in properties like the collective sale relaunch site but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.