Singapore—Citing the current uncertain economic climate and saying that there are excess untapped revenue streams, the Workers’ Party (WP) has argued against the upcoming increase in the Goods and Services Tax (GST).

Although the GST hike from 7 to 9 per cent announced during the rollout of Budget 2018 has been postponed, it cannot be delayed forever, said Deputy Prime Minister Heng Swee Keat on Feb 16, when he announced this year’s Budget.

It will not take effect this year, but will do so between 2022 and 2025, depending on economic conditions, Mr Heng added.

“However, we will not be able to put off the increase for too long. We will have to make the move some time from 2022 to 2025, and sooner rather than later, subject to the economic outlook.”

The WP, however, has a different perspective, which it outlined in a Facebook post on Saturday (Mar 13).

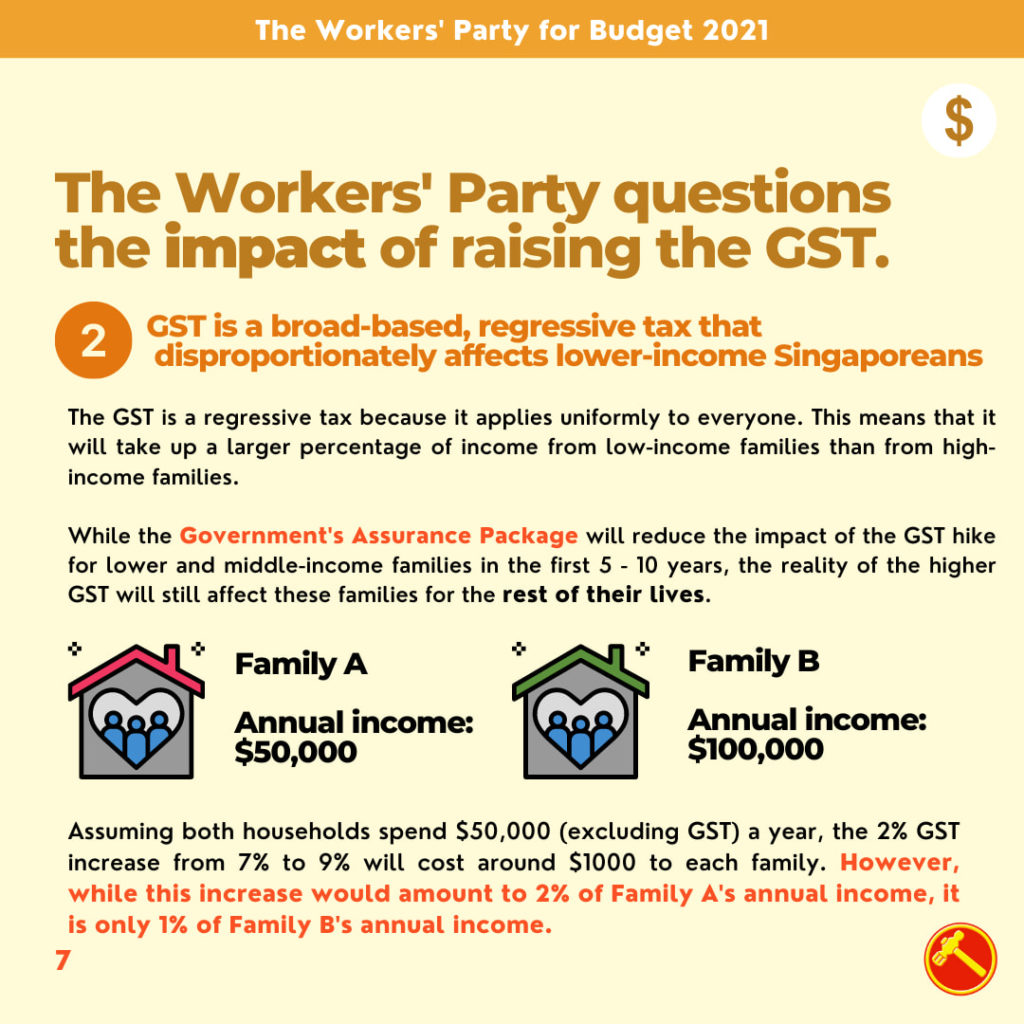

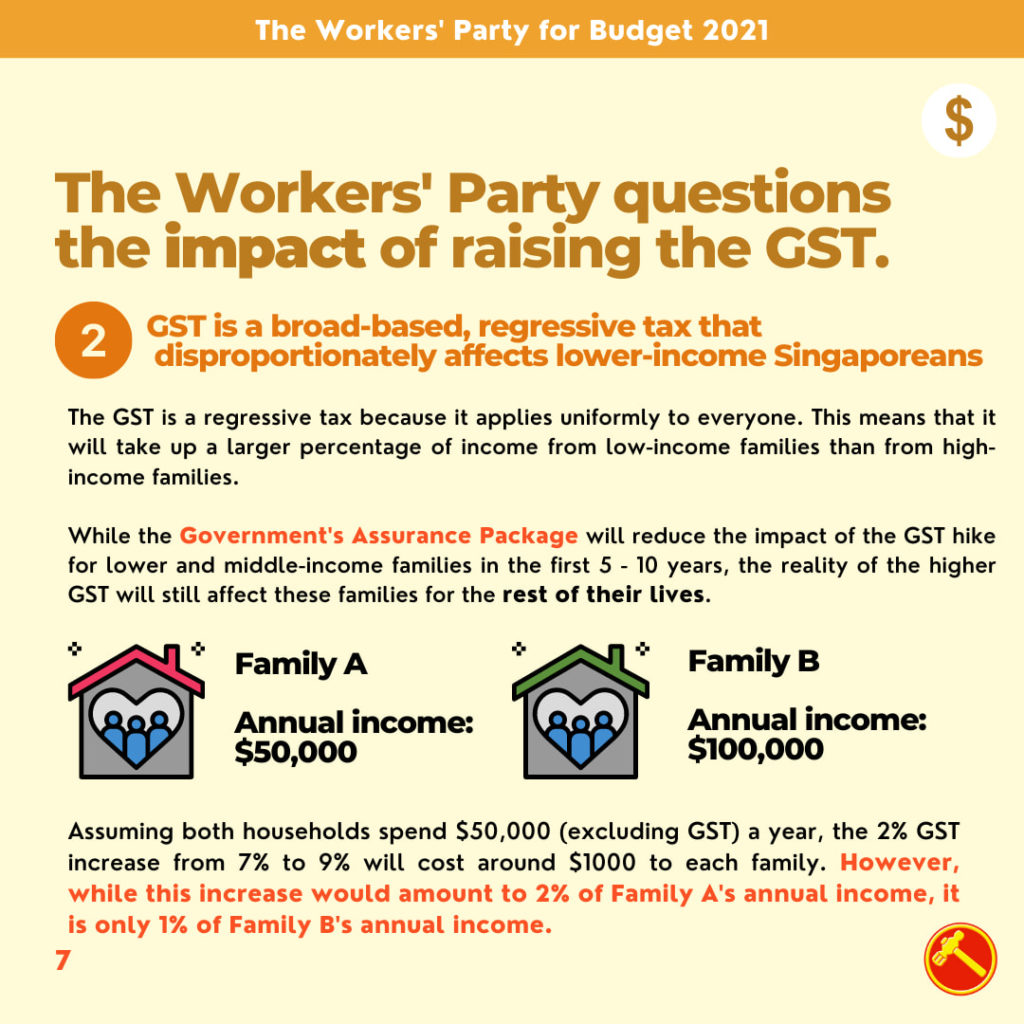

“The Workers’ Party is against raising the GST given the context of excess untapped revenues, especially in this uncertain climate. The GST is a regressive tax and while we can defer the impact on lower income families in the near term, it will hit everyone for the rest of their lives thereafter,” wrote the opposition party.

The post has been shared almost 500 times.

The WP has pointed out alternatives to the GST increase and asked for a review of the proposed hike.

First, the WP wrote that annually, between 2011 and 2019, the Government generated a recurring cash surplus of $29 billion on average.

The opposition party has asked questions about the proposed hike for the past three years, specifically questioning the urgency to increase revenue and impose a broad-based, regressive tax in light of the Assurance Package to help Singaporeans with smaller incomes.

Additionally, the WP said that instead of a S$32 billion deficit, the Government actually has a budget surplus of $205 billion for 2011 to 2020.

Furthermore, since the GST is across the board, it would have a greater impact on lower-income households in the country.

As an alternative to a GST hike, a proposal to increase the Buyer’s Stamp Duty as well as impose an Additional Buyer’s Stamp Duty was made in Parliament by Mr Leon Perera (Aljunied GRC).

Mr Louis Chua (Sengkang GRC) has also proposed a wealth tax.

/TISG

Read also: Jamus Lim shares why he joined Workers’ Party

http://theindependent.sg/jamus-lim-shares-why-he-joined-workers-party/