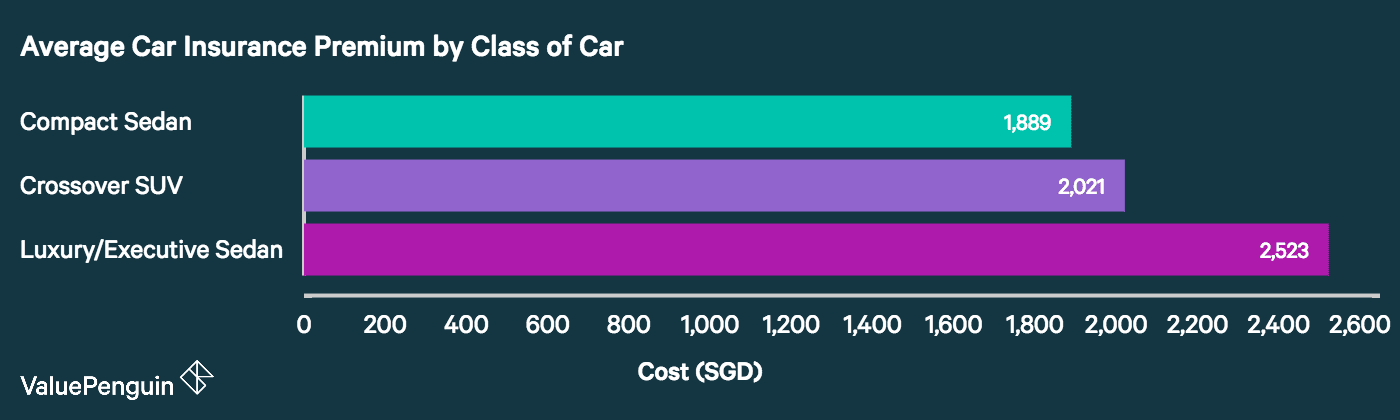

Do you know how much you should be paying to insure your car? Most people in Singapore buy their car insurance at the dealership when they buy their cars. What you may not realise is those policies sold by the dealers can cost hundreds of dollars more than what it would if you were to buy it online. Our team at ValuePenguin thinks that you should have all the facts before you buy. So we crunched the numbers to find out how much, on average, you should expect to pay to insure three types of cars in Singapore: the compact sedan, crossover SUV, and luxury sedan*.

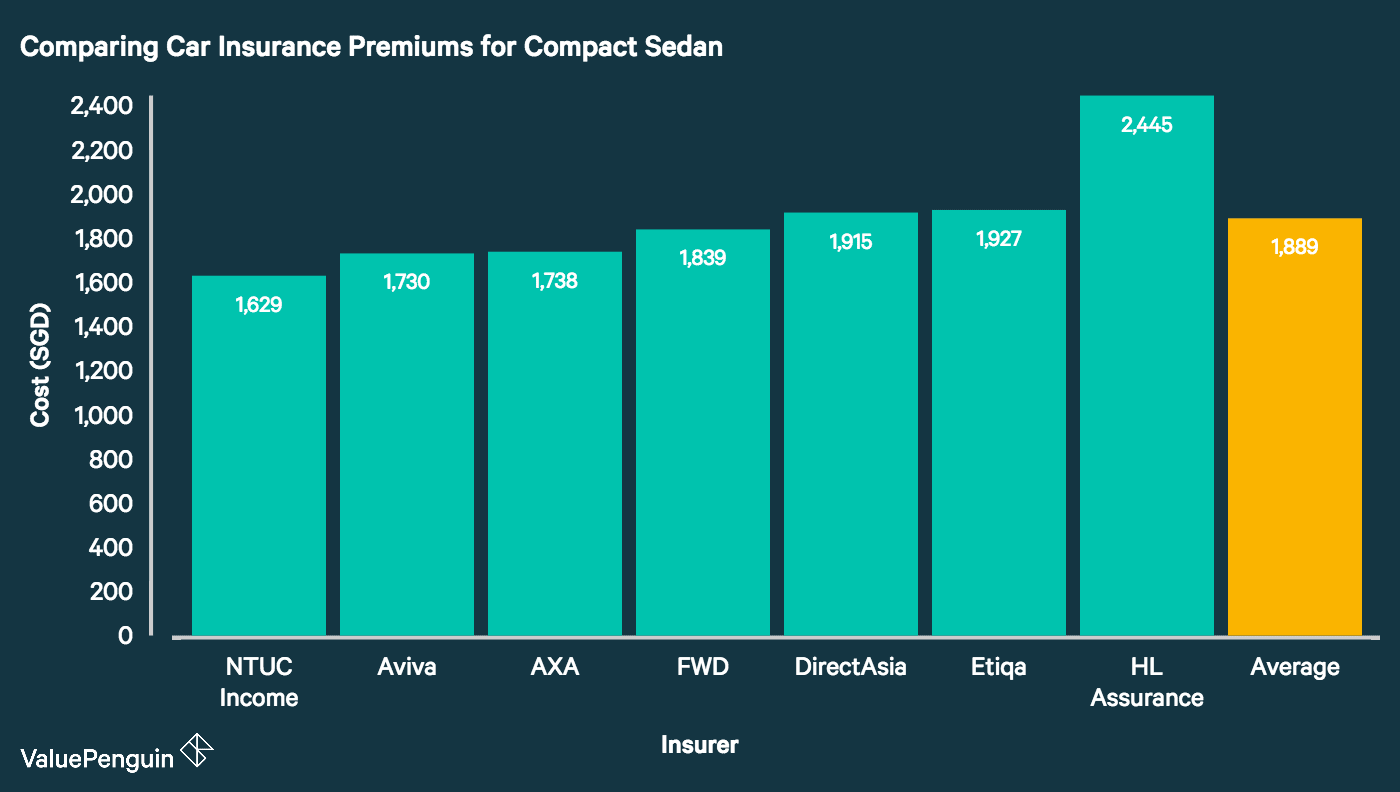

Average Cost to Insure a Compact Sedan

Featuring cars like the bestselling Toyota Corolla Altis, the compact sedan class is both popular and relatively affordable in Singapore. To get an idea of the average cost of insuring a compact sedan, we collected quotes from 7 major insurers for the Toyota Corolla Altis, the Honda Civic and Mazda Mazda3. Our study found that in general, you might expect to pay around S$1,900 a year on your car insurance premium for a car like this in 2017. NTUC Income, Aviva and AXA tend to offer the lowest prices for cars within the compact sedan class.

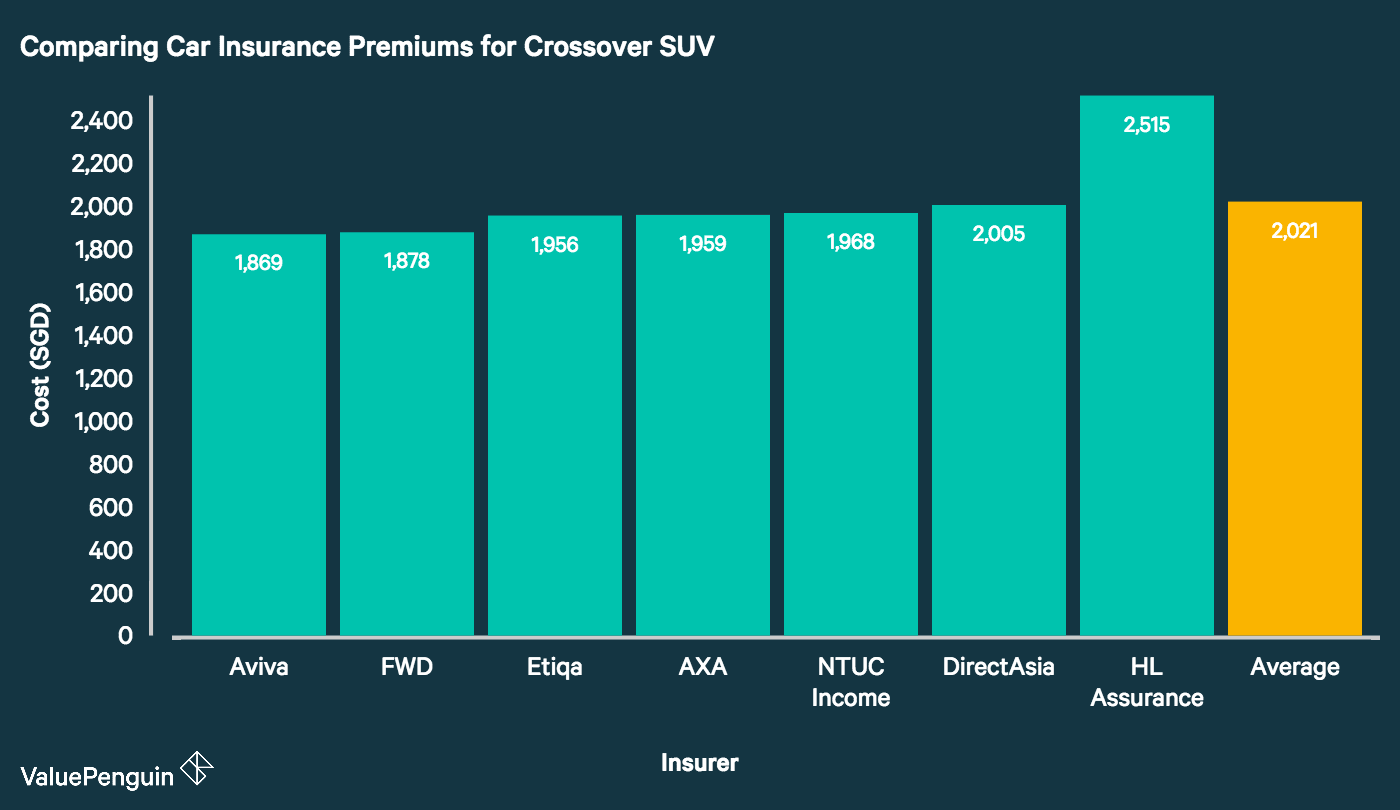

Average Cost to Insure a Crossover SUV

Crossovers are increasingly widespread in Singapore, as they offer an attractive blend of sportiness, safety and space that make them a versatile choice in Singapore’s crowded streets. After collecting quotes from Singapore’s top insurers for the Honda HR-V and Nissan Qashqai, two of Singapore’s most popular cars in this category, we found that the average car insurance premium for a crossover SUV is about S$2,000 a year. Overall, Aviva and FWD generally seemed to offer the lowest premiums for crossovers.

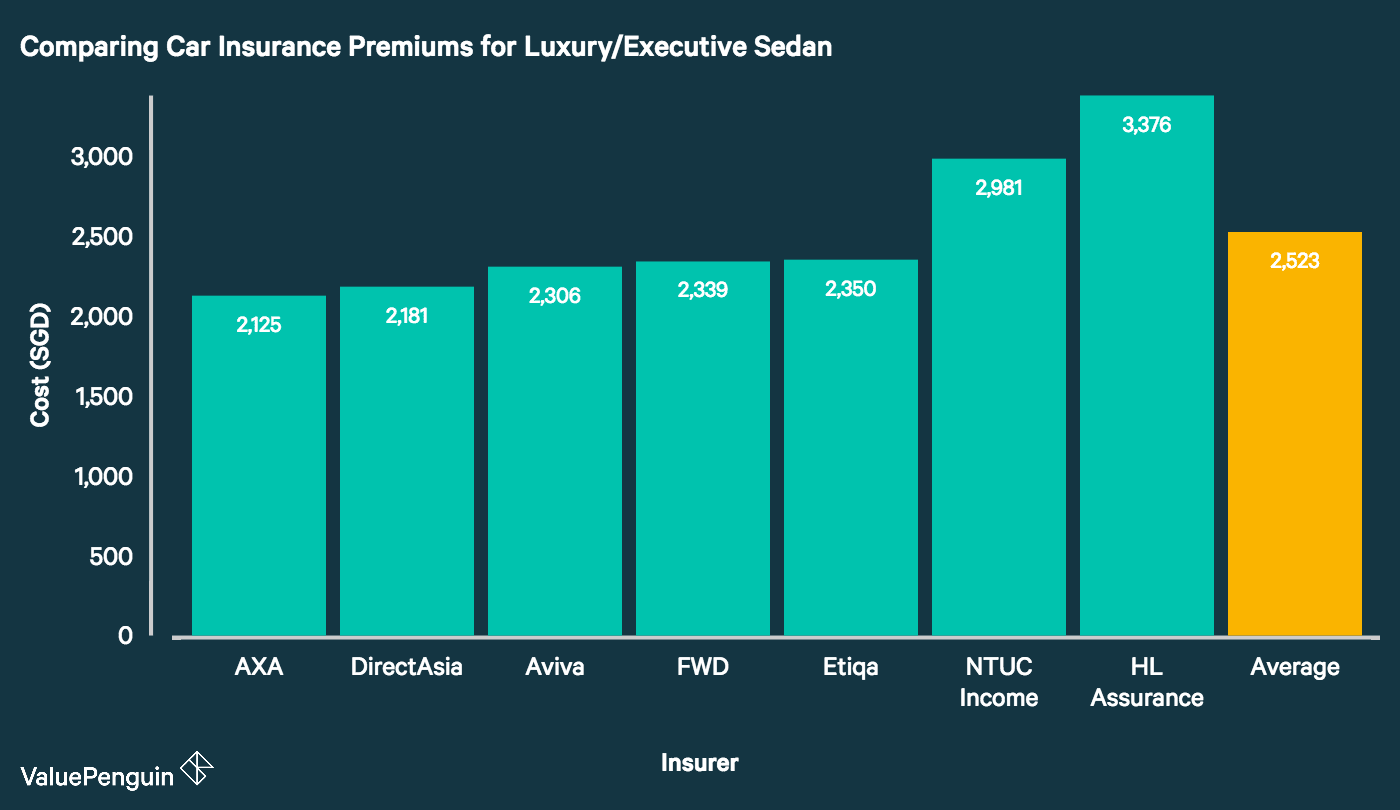

Average Cost to Insure a Luxury/Executive Sedan

Luxury brands such as Mercedes-Benz, BMW and Audi offer a wide range of performance vehicles to suit a variety of tastes when it comes to size, performance and styling, and insurance premiums do fluctuate along with those variations. For the purpose of our study, we chose to look at one of the most consistently popular luxury cars in Singapore, the Mercedes-Benz E Class, and its immediate competitors, the BMW 5 Series and the Audi A6. On average, you might expect to be charged car insurance premiums in the area of S$2,500 a year on a luxury sedan of this sort. We found AXA and DirectAsia to offer the most consistently competitive premium prices for this category of car.

Parting Thoughts

It’s not surprising that car insurance premiums tend to correlate with the cost of your car. However, they do not increase in proportion with the cost of your vehicle. For example, a luxury car like the Mercedes E-Class or BMW 5 series costs about 125% more than a compact sedan like the Toyota Corolla Altis. But the average cost of insuring that luxury car will only be about 32% more expensive than the average cost of insuring a compact sedan. So while you may pay more than double to buy a luxury car what you would for a compact car or a crossover, keep in mind that you won’t generally have to pay double the amount in insurance as well.

Ultimately, you should make sure to shop around as much as you can before settling on a car insurance plan. With potential savings of hundreds of dollars every year on the line, doing your homework is definitely worth it.

Methodology

For our study, we used a driver profile of a 30-year-old male with 2 years’ driving experience and 0% NCD. Quotes you may actually receive from insurance companies may change depending on your age, occupation, gender, years of driving experience, and NCD, among other factors. However, these prices may give you a useful benchmark and starting point to find the best insurance policy for you.

We collected quotes from AXA, NTUC Income, Aviva, DirectAsia, FWD, Etiqa and HL Assurance, which were chosen for their prominence in Singapore as well as the ease of gaining online quotes on their websites. AIG, one of Singapore’s biggest insurers, is not represented because it no longer offers an online quote service on its website.

The article Probability of Getting in a Car Accident in Singapore originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Source: ValuePen