Go-Jek has begun rolling out its e-wallet feature Go-Pay for transactions outside of its ecosystem. e27 sets out on a journey to test it out

Since the startup’s first claim to fame in 2015, Go-Pay has always been an integral part of the Go-Jek experience. Embedded into the Go-Jek mobile app, users can top-up some amount of funds into the e-wallet feature and use it to pay for Go-Jek services from ride-hailing, food delivery, to express courier.

An interesting development happened in July 2017 with the launch of Go-Resto, which aims to enable Go-Food drivers in general to do transactions at various F&B and merchant outlets using Go-Pay. The platform was launched with the expectation that eventually, customers will be able to use Go-Pay for transactions outside of the Go-Jek ecosystem.

The prospect of being able to use the cashless payment system to buy food at the mall (and other daily necessities) seemed promising in a market where cash is king –and a long-reigning king, that one is.

So when Kompas Tekno reported that several street food stalls in Kebon Sirih, Central Jakarta, have begun to accept Go-Pay for payments, followed with the launch of Go-Pay at several offline and online merchants, I decided that I just had to try these myself.

So off I went to a three-day shopping trip to test out Go-Pay at various merchants.

The experience

Just in time for Ramadan, together with several leading retailers, Go-Jek launched a special promo that will allow users to get cashback by using Go-Pay to pay for their transactions.

Guided by the list of merchants on their site, I started off by paying visits to bubble drink outlet Chatime and bookstore chain Gramedia to test out the new service.

Also Read: Indonesian ride-hailing giant Go-Jek to launch online content production house, streaming service

There was a considerable queue at Chatime as it was near time for iftar; people in the mall are getting themselves ready by buying food and drinks.

I took the risk of being called a creep by watching every single person standing before me, and what they used to pay for their drinks. The majority of them used cash, followed by credit or debit cards, despite notification on the cashier that this shop accepts Go-Pay.

When my turn came, I asked the shopkeeper if it is possible for me to use Go-Pay. She said yes and took out an EDC machine with a Kartuku label on it.

(Friendly reminder that fintech startup Kartuku was acquired by Go-Jek in December 2017.)

The machine then printed out a piece of paper with a QR code on it. I opened the “scan QR code” part on my Go-Jek app and scanned the code. The next thing that showed up on my screen was an option to choose between the Go-Jek and Go-Life apps.

I picked the Go-Jek app and confirmed my purchase with a passcode; withing seconds, my purchase was approved. I got to left the counter with a sense of victory; I liked to imagine that people were staring at me enviously as well.

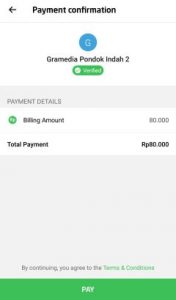

The next day I decided to stop by Gramedia. Honestly I had no plan to buy any book at the moment, so I stopped by the magazine section and got some back issues as they were really cheap.

Like the previous day, I was also the only person in the waiting line who was using Go-Pay for transactions. The lady behind the cashier even said that this was the first time she ever used it to process a transaction.

We repeated the same process as the one at Chatime, and once again I walked out of the store excited.

My journey continued the next day to a noodle shop in South Jakarta which had been reported to accept Go-Pay as payment method. But unfortunately this is the first time I have been let down by the experience, as despite the reports, the cashier told me that the Go-Pay service is meant only for Go-Food drivers.

Also Read: Go-Jek, Openspace inject money into Bangladesh’s bike-hailing startup Pathao

I am not sure what happened here. Have I been misguided by the reports, or does it indicate the lack of communication between the noodle shop management, Go-Jek, and the staff?

No idea. But all that matter is that in the past three days, I have gotten enough materials to make a verdict.

Indonesia’s cashless revolution

If you have been using Alipay in China or ApplePay in Singapore, you may wonder: It is 2018 and someone in Indonesia is actually excited about using a QR code-based payment?

We have every right to be excited as we have been behind when it comes to the use of cashless payment methods. In the same way Go-Jek was not the first business to try to digitise ojek services, they were also not the first company to offer e-wallet service in this market. Think DOKU or Tcash.

Yet, as successful as these businesses go, they still fail to make e-wallet a must-have item in every Indonesian’s smartphone. No matter where we go, we always have a stack of cash ready in our wallet.

Let me explain to you why.

It is said that the lives of a typical Indonesian, particularly in Jakarta, revolve around the nearest shopping malls. True, we spend countless weekends and nights at shopping malls, hanging around or even just waiting for the traffic jam to calm down. But there is life outside the shopping mall, and this is why we always have a stack of cash ready.

As you move your car out of a parking lot, there will always be a tukang parkir (“Parking man”) showing up with a whistle to help you out.

You wait in a traffic jam, and a street seller showed up on your window with bottles of drinks. You decided to buy one.

You aim to take a U-turn but the other cars and motorbikes just will not let you. A group of teenagers showed up to help you get your chance. They expect reward, so you handed them some coins. This profession is called a pak ogah.

Once you arrived at home, you realised that you are running out of sugar for your evening tea. So you walk out to a nearby warung.

These are all the kind of services provided by small businesses and individuals that are essential to the life of every Indonesian. And these services can only accept cash.

(I personally have never seen a pak ogah with an EDC machine, so yeah. These services are also the reason why vending machines will never be popular here.)

Also Read: Go-Jek to invest US$500M to support international expansion plan

Now let us link it back to the reason why previously released services such as DOKU and Tcash did not work.

Many of these services team up with retailers at the malls, which is great until the customers walk out of the mall itself.

Also, while Tcash has recently announced its plan to become agnostic, the service was previously only available for users of mobile operator Telkomsel.

I personally find it off-putting to sign up for something new. Last year the government made it obligatory for all toll roads to use cashless payment methods; only then I actually applied for one, as provided by the bank. Because otherwise I would not be able to use the highway.

This is why Go-Pay might actually has the chance to bring forth the cashless revolution.

Though they have also used to strategy of partnering with major retailers, they also include small businesses and street food sellers as part of their launch strategy, covering a previously untouched segment by cashless payment methods providers.

The platform also have a network of small and big F&B retailers through its Go-Food service; looking at all the services available on the Go-Jek platform, there is a strong possibility that one day we get to use Go-Pay for transactions at the cinema, the pharmacist, or the supermarket.

The e-wallet is also integrated into a mobile app that provides a core service that is even more essential to Indonesians’ life than the malls: Transportation. (Otherwise how do you get to the mall!?)

With an integrated service, you do not have to download another app or sign up for something with the bank. If you are lazy like me or have limited space on your smartphone, this is a great way to lure you in.

Now what?

So what is next for Go-Pay? Considering the fact that the service has only been launched in the past one month, there is a limited number of merchants that we get to use it in. This is understandable, but we are definitely looking forward to see more coming. Not only in numbers, but also in variety. If my favourite laundry shop starts to accept Go-Pay next month, I will be a very happy person.

Also Read: Southeast Asia is setting itself up for disappointment with Go-Jek entrance

If there is anything that Go-Jek needs to work on, is educating the customers about the existence of such service. As I have explained in previous paragraphs, I was the only shopper in the queue line who was using the service. I talked to friends and families about my experience shopping with Go-Pay; most of them are even shocked that you can actually use Go-Pay at Starbucks.

What is the best way to educate the society about this service? I honestly do not know. Promos are nice, but sometimes people need to be encouraged by seeing a person using the service in real life. Hopefully the person standing behind me in Gramedia will be inspired to use his Go-Pay for buying books.

The last thing I am going to say is that: Your move, GrabPay.

The post I used Go-Pay to buy these magazines and a bubble drink. Here is why I think it’s game-changing appeared first on e27.

Source: e27